Ever feel like diving into the stock market is a bit like jumping into cold water? It’s exciting, but there’s always that nagging fear of losing your hard-earned money. What if  there were a way to ease in slowly—without exposing yourself to too much risk? That’s where cash-secured puts come in. This strategy gives investors the opportunity to buy stocks they like at a discount, while getting paid upfront for simply waiting.

there were a way to ease in slowly—without exposing yourself to too much risk? That’s where cash-secured puts come in. This strategy gives investors the opportunity to buy stocks they like at a discount, while getting paid upfront for simply waiting.

In this article, we’ll explore how cash-secured puts work, why they appeal to more conservative investors, and how you can use them to build wealth over time without taking on unnecessary risks.

What is a Cash-Secured Put?

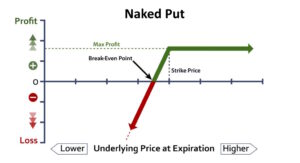

At its core, a cash-secured put is an options strategy that gives you the potential to buy a stock at a lower price while earning a premium in the process. It’s called “cash-secured” because you’re required to keep enough cash in your account to purchase the stock at the agreed-upon price (the strike price) if the market takes a downturn.

A Simple Analogy: The Car Purchase Example

To understand the mechanics better, think of it this way:

To understand the mechanics better, think of it this way:

Imagine your friend is looking to sell a car but is worried the price might drop by the end of the month. You offer to buy the car from them for $10,000 if the price drops that low within 30 days. As a thank-you for making the promise, your friend gives you $200 upfront for your commitment.

- If the price drops to $10,000 or below, you buy the car for $10,000 as agreed—and you still keep the $200 premium.

- If the price stays above $10,000, the deal expires, and you don’t buy the car. But you still keep the $200, effectively earning a small profit just for making the offer.

This is exactly how cash-secured puts work in the stock market, but instead of cars, we’re talking about stocks and strike prices. If the stock falls to your desired price, you buy it at a discount; if it doesn’t, you still walk away with the premium as profit. Either way, it’s a win-win scenario for investors with a long-term outlook.

How Do Cash-Secured Puts Work?

Here’s a step-by-step breakdown of how the strategy plays out:

- Pick a Stock You Want to Own: You start by identifying a stock you wouldn’t mind owning, but at a lower price than it currently trades.

- Sell a Put Option: You sell a put option on that stock with a specific strike price (the price you’re willing to buy the stock for) and an expiration date (usually a few weeks or months away).

- Set Aside Cash: You keep enough money in your account to buy the shares if the stock falls to the strike price. For example, if you sell a put on 100 shares with a strike price of $50, you need $5,000 ($50 x 100) in cash.

- Collect the Premium: You receive a premium (payment) immediately after selling the put.

- Wait for Expiration: If the stock price stays above the strike price by expiration, the put option expires worthless, and you keep the premium as profit. If the stock drops below the strike price, you’ll be required to buy the shares at the agreed price—but you still keep the premium, softening the blow.

This strategy lets you earn income even if the stock doesn’t move in your favor—a great bonus for patient, long-term investors.

Why Conservative Investors Love Cash-Secured Puts

The cash-secured put strategy isn’t about chasing high-flying growth stocks or making speculative bets. It’s designed to align with a more cautious, income-focused approach. Here’s why conservative investors are drawn to it:

1. A Chance to Buy at a Discount

Selling a put allows you to purchase a stock you like at a lower price. If the stock doesn’t fall to your desired level, you still earn the premium for trying. Think of it like getting paid for placing a “buy limit” order—except with cash in your pocket from the start.

Example: Say XYZ stock trades at $55, but you’d only want to buy it at $50. You sell a put with a $50 strike price and collect a $2 premium. If the stock stays above $50, you keep the $200 premium (since options cover 100 shares). If the stock drops to $50 or below, you buy the shares for $50 each—effectively paying $48 per share after factoring in the premium.

2. Generates Income No Matter What Happens

Whether the stock reaches the strike price or not, you earn the premium when you sell the put option. If you’re not immediately looking to buy, this income generation can provide some nice returns while you wait for better prices.

Stat to Know: The average return from selling puts can range from 1-2% of the stock’s value per month, depending on the volatility of the stock. Over time, these small premiums can add up to substantial income.

3. Built-In Risk Management

This strategy has built-in protection because you’re only selling puts on stocks you want to own. Plus, setting aside the cash ahead of time ensures that you won’t get caught scrambling if the stock price drops and you need to purchase shares. In short, there are no margin calls or nasty surprises.

“Cash-secured puts offer a way to stay active in the market without overextending yourself. It’s a perfect strategy for patient investors who are willing to buy stocks at their target price,” says market analyst Michael Batnick.

4. Better Than Sitting on Cash

Holding cash in your account earns little to no interest, but using cash-secured puts allows you to earn extra income without taking on the same risks as buying a stock outright. Even if the market is flat or slightly down, you’re still collecting premiums.

This makes cash-secured puts an attractive option for investors waiting for market corrections. Instead of sitting on the sidelines, you’re actively generating returns.

What Are the Risks?

While cash-secured puts are safer than many other options strategies, there are still risks involved:

- Falling Stock Prices: If the stock plummets far below your strike price, you’ll still have to buy it at the agreed price, even if it’s now worth less.

- Opportunity Cost: If the stock rises significantly, you miss out on buying it at the lower price—and you only keep the premium.

- Tied-Up Capital: You need to have cash set aside, which means that capital isn’t available for other investments during the duration of the trade.

However, the risks are mitigated by the fact that you only sell puts on stocks you want to own, and the premium earned reduces your effective purchase price.

How to Get Started with Cash-Secured Puts

If you’re ready to try this strategy, here are a few steps to follow:

- Choose Quality Stocks: Focus on blue-chip companies or stocks with a strong track record.

- Select a Reasonable Strike Price: Aim for a strike price that matches your valuation of the stock.

- Pick the Right Expiration Date: Shorter expiration periods (2-4 weeks) offer quicker income but require more frequent trades.

- Monitor the Market: Keep an eye on stock movements to decide whether to let the option expire or roll it into a new one.

Pro Tip: Start small by selling puts on just a few shares to get comfortable with the process. Many brokers offer practice accounts that let you test strategies without real money.

A Smarter, Safer Way to Enter the Market

Cash-secured puts are a powerful tool for conservative investors looking to generate income while waiting to buy stocks at the right price. This strategy offers the best of both worlds: downside protection and consistent premiums. While there are risks involved, selling puts only on stocks you want to own makes it a low-stress way to participate in the market.

If you’re tired of sitting on cash but wary of diving headfirst into volatile markets, cash-secured puts could be the perfect compromise. It’s like getting paid to be patient—something every investor could benefit from.