Strangles – What are they and How do we Trade Them?

Strangles are the only uncapped risk, limited reward strategy we trade. As a result we are highly selective about how we trade Strangles.

We base our strangle trades like we place our probability based non-index and Broken Wing Iron Condors. We use probabilities and volatility. In addition because these are uncapped risk we typically only trade stocks that have predictable moves. We stay away from stocks that might have sudden earnings like pharmaceuticals. We also try to have only one stock from a particular industry in our Strangle portfolio at a given time, just in case something affects that entire industry.

use probabilities and volatility. In addition because these are uncapped risk we typically only trade stocks that have predictable moves. We stay away from stocks that might have sudden earnings like pharmaceuticals. We also try to have only one stock from a particular industry in our Strangle portfolio at a given time, just in case something affects that entire industry.

Some stocks that we like for Strangles at the time we are writing this are: MSFT, DIS, MCD, NKE, CAT, MU and others. This is not meant as a complete list, only to give you an idea of what we are looking for.

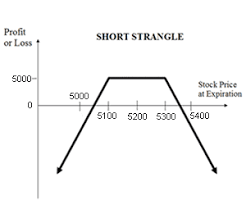

If you do not know what a Strangle is, let’s dive into that first. First of all, we typically only short Strangles, that is why we said we have unlimited risk and capped profit potential. If you buy a Strangle it is the opposite but we rarely do that. We have found shorting Strangles to have a higher success rate if done correctly. Or at least following a set of rules we have worked on over the years.

A short Strangle, the way we trade them, consists of selling a out of the money (OTM) Call and an OTM Put against a security. Your potential profit is the credit you received for placing the Strangle and your potential risk is unlimited to the upside and the stock price down to $0.00 to the downside. For all practical purposes we call that unlimited on both sides.

Perhaps it is easier to give you an example at this point.

We recently shorted a Strangle in MCD.

With MCD trading at $179.16 we sold a Strangle which expires in 45 days. We sold the $187.50 Call and the $170.00 Put for a credit of $2.02 or $202.00 per contract. Our overall risk is unlimited but the effect on our buying power is $2,750.00. Buying power effect can vary depending on a number of factors. If we held to close our return would be 7.3%

As soon as we placed the trade we placed at Good to Cancel (GTC) order for $1.65 meaning we are going to try and make $37.00 per contract on this trade. If our GTC order hits we make about 1.3% on this trade. I know that does not sound like much but this is a very high probability trade. In addition our average time in a Strangle is about 10 days as we are writing this.

This means we could theoretically get a 1.3% return every 10 days if nothing goes wrong. Annualized that would be about 47.45% return on buying power used.

So, what are the short Strangle rules we use (most of the time)?

- Use high quality, somewhat predictable stocks. You do not want a stock with a history of large random movements.

- Higher volatility improves your chances of success. Here we are referring to a higher volatility for the stock you are trading not overall volatility. A pharmaceutical might have a much larger volatility but we are only concerned where our stock is as compared to historical volatility.

- Try for a potential initial return of about 10% as long as it has a probability of success over 65%.

- Look to close for around a 3% return or about 35% of your initial credit. So if your initial credit was $2.00 then you would consider closing at $1.30 giving you a $.70 profit.

- Try to get a probability of over 65%. We use the TDAmeritrade platform to give us probabilities, you could use Delta’s and Volatility to calculate but that is more than we are getting into here.

- Try to find short Calls and Puts that are at support and resistance points. Use the chart and see what looks like a good place to put your Calls and Puts. If one of them appears to be in the middle of a price action zone the find another security to trade.

- Stay away from stocks with earnings or other news announcement before expiration if you are short a Strangle. The opposite applies if you are long a Strangle.

- DO NOT over trade them. These types of trades make up about 10% of our portfolio. REMEMBER uncapped risk!

Adjustment Rules. Again, these are the ones we try to follow. But, you  have to decide for yourself where you need to adjust.

have to decide for yourself where you need to adjust.

- If the loss on the trade is showing more that twice what you are trying to make. In the MCD trade above since we are trying to make $37.00 if the trade ever shows a $74.00 loss we need to look at it.

- If the price of the underlying security is approaching one of your short options.

- If you have to adjust try to close the trade at just above break even. The security has already moved against you, it might be best to just get out as soon as you can and move to the next trade.

How to Adjust.

- You can always just close the trade for a loss or small profit.

- You can roll the Strangle out another week or more. Only do this if you can do it for a credit AND it places your new short positions at a strong resistance or support level.

Here is an example of a Strangle we had to adjust.

We placed a trade in NKE with about 45 days to expiration. NKE was trading at $80.10 when we placed the trade by selling the $85.00 Call and the $75.00 Put.

Fourteen days later NKE was trading at $85.15, because of time decay and the loss of value in our short Put we were not showing a loss of twice what we were trying to make. So, instead of closing we decided to look for a roll.

Our initial break even to the upside was $86.64 (our short call plus the $1.64 credit we received when we placed the trade) which was right at the 52 week high.

We found a roll that pushed the trade out another week and brought in an additional $.34 credit. So, we rolled the trade from a short $75/$85 Strangle to a $79/$87.50 Strangle. With the move up in our short call and the additional credit we moved our break even point to the upside to $89.42, well above the 52 week high. Plus we did it by only adding a week to the trade.

Adjustments don’t always work out this well. If the trade moves against you quickly or you can’t improve your odds you are sometimes just better to close.