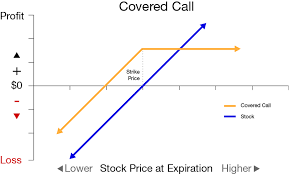

Poor man’s covered call strategy is an innovative way to make money through the stock market without investing a lot of money or having to be an expert in financial matters. This type of investing strategy can be both lucrative and low-risk if done correctly. Read on to learn the secrets to profiting from […]