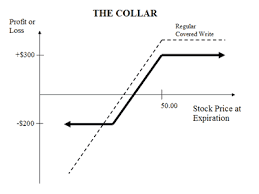

If you’re looking for a way to generate regular income from your stock portfolio, the covered call strategy might be just what you need. This popular options trading technique allows investors to earn premium income while holding onto their stocks, making it a great way to enhance returns in a relatively low-risk manner. In this […]