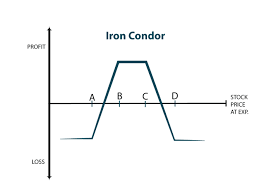

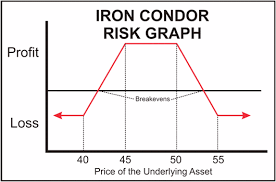

Reaping Low Volatility Profits with an Iron Condor Options Trade Iron condors are options spreads that bear a resemblance to iron flies. Both options strategies profit from low volatility in the underlying stock. An iron fly is bearish strategy that targets short put options, while an iron condor is a bear spread that involves short […]