CELG – 7/13/18 – Long Call CELG had been in a sideways move after a down trend. I watched it move up then retrace just above weekly support and decided to purchase the $80.00 Calls expiring on 9/21/18 with CELG trading at $85.51. My initial mental target was $87.58 with my stop around $83.47. […]

Month: January 2019

What are Fibonacci Levels

What are Fibonacci Levels Fibonacci lines are a very popular tool technical investors use to determine potential price action. They use them to help find support and resistance points. In fact, they may very well be the most popular of all trading tools. We know there are many people that do not believe in Fibonacci […]

PCAR – Long Call – 7/12/18

PCAR – 7/12/18 – Long Call On 7/12 I noticed and evening start pattern on the PCAR chart and decided to traded it. I purchased an ITM Put option with a Delta of 71 so I would make money a little faster if the stock continued down. I had to pay a little more for […]

Does Robot Trading Work?

Does Robot Trading Work? Don’t like to read? See the YouTube video by CLICKING HERE Everyone wants an easy way to make money trading securities. We want an automated process that requires no thinking on our part. Just plug and play like the rest of our lives. Why does Robot Trading appeal to People? Fear […]

CELG – Covered Call – 7/31/18

CELG – 7/31/18 – Covered Call This is a standard covered call I entered in CELG. You will notice on the chart below how the price changed over the 37 days I was in the trade and how I defended my short Calls. The only mistake I made was on 8/31 I was going to […]

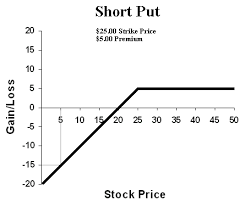

Covered Call Naked Put Strategy

The Covered Call Naked Put Strategy There are a lot of ways to get into a covered call trade. We actually prefer to use Diagonals but there is another way that can be very profitable if properly traded. If you trade options for profit or stocks for profit you need to know the best ways […]

ATVI – Covered Call – 7/6/18

ATVI – 7/6/18 This was another of a series of trades I did in ATVI as I tracked it through a number of different trades. This time I actually purchased shares of ATVI and entered into a standard covered call. With ATVI trading at $77.06 I bought 100 shares and sold a $77.00 call that […]

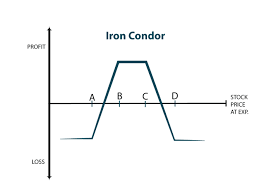

What is the Difference Between Buying and Selling an Iron Condor?

What is the Difference Between Buying and Selling an Iron Condor? Risk, reward and probability of success. Like most things in life the more risk you take the higher your potential reward but the lower chance of success. This is buying an Iron Condor On the other hand, if you take less risk your reward […]

QQQ Iron Condor – 9/10/18

QQQ – 9/10/18 – Iron Condor Decided to place a QQQ trade on 9/10, really the credit I got was not all that great when I entered the trade. I was trying to stay in the market and liked the strikes I was able to get so decided to go for it. When I entered […]

HD Iron Condor – 9/5/18

HD – 9/05/18 – Iron Condor On 9/5 I decided to place an Iron Condor trade on HD. HD was trading at $204.27 with an implied volatility rank of 13, not great but I decided to go with it anyway. When I placed the trade I had a 60.5% probability of success if I held […]