In 2016 our overall success rate was 65.52% In 2017 our overall success rate was 66.67% In 2018 our overall success rate was 71.11% In 2019 our overall success rate was 62.61% In 2020 our overall success rate was 73.41% In 2021 our overall success rate was 69.77% In 2022 our overall success rate was […]

Month: January 2019

Understanding Option Greeks

Do you know what Option Greeks are? Do not worry of you don’t most people either do not know what they are or think they are too difficult to understand to even try. Good news, they are not difficult at all. Further good news, the main one we use is Delta so you do not […]

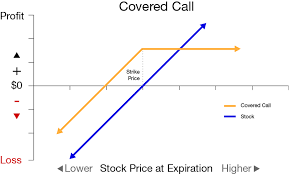

What is the Best Type of Covered Call Trade?

What is the Best Type of Covered Call Trade? This is kind of a trick question because we believe the best type of Covered Call trade is not a Covered Call at all. We prefer to trade Diagonal Option positions instead of a traditional Covered Call. Let’s start with what is a Diagonal Call trade, […]

How to Find the Right Stock to Swing Trade MA CCI

How to find the right Stock to Swing Trade MA CCI First of all, there are lots of different methods to finding a good stock to swing trade and from time to time we like to discuss various options. One our favorites is using two simple moving averages to determine a trend and the Commodity […]

52 Week High Trading Strategy #1

52 Week High Trading Strategy Are you looking for a new ideas about finding a trade? There are a number of different strategies revolving around stocks reaching a 52 week high. Today we want to discuss one that is worth taking a look at. Keep in mind we are not saying this strategy will work […]

Why Pay $1,999.00 to Learn to Trade?

Why should you have to pay thousands of dollars to learn to trade when we will get you started for less than $10.00? Do you just like to waste your money? Do you think that the ‘Guru’ who is spending THOUSANDS of dollars to get you to purchase his service is really giving you your […]

MU – 10/18/18 – Look Back Trade

On 10/18 we entered into a Broken Wing Iron Condor trade on MU. Because of the design of the trade we ended up with no risk to the upside and a pretty good maximum profit range. We used the 41/37 Puts and the 42/23 Calls to build our Broken Wing Iron Condor for about a […]

PCAR – Look Back Trade

Today we want to review a trade we made back in July. On 7/12/18 we noticed an Evening Star pattern in on the PCAR chart and jumped into a quick Options traded to take advantage of it. With PCAR trading at $61.34 we purchased a 11/16 $67.50 Put expecting a move down. This option was […]