A collar option strategy is an options strategy that involves buying stock, stock futures, or options to create a position that has downside protection and the potential for profit if the price of the underlying asset rises.

A stock collar strategy is a combination of covered call and long put options designed to limit losses if the price of the underlying stock drops. This strategy can be used by both long-term holders of stock who are interested in limiting downside risk and short-term traders who have the option of selling covered call options. Let us now look at the different types of collar options available, the risk involved, and how you can apply this strategy in your trading career.

What Is a Collar?

A stock collar option is a type of option with an expiration date that has a strike price collar attached to it. The strike price collar is the maximum price the option can be trading at on the expiration date. The collar option strategy is commonly used by traders looking to profit from volatility in stock prices.

date. The collar option strategy is commonly used by traders looking to profit from volatility in stock prices.

The stock collar option strategy involves buying call options with strike price collars and selling put options with strike price collars. These call options typically have a higher payout than put options and the trader gains more money if the underlying stock price increases above the strike price of the call option than if it increases below the strike price of the call option. Similarly, put options have a higher payoff if the underlying stock price falls below the strike price of the put option than if it rises above it. Thus, by trading call options with strike price collars and put options with strike price collars, a trader can profit from volatility in stock prices and hedge his or her position accordingly.

Another advantage of trading call options with strike price collars is that it does not require large capital for trading as compared to other options trading instruments such as binary options and futures.

However, there are also some risks associated with stock collar options trading, like market volatility affecting the strike price of the call option, which may lead to losses as well as holding onto call options for too long may result in losses due to expiration of the option itself. Thus, proper risk management should be followed while trading call options with strike price collars.

Understanding a Collar

A collar option trading strategy is a strategy of investing in stock options that uses the stock price collar as its profit target. The stock price collar strategy involves investing in put options with strike price equal to the stock price and call options with strike price higher than the stock price.

With the stock price collar trading strategy, the investor makes money when the underlying asset’s price reaches a certain level (the stock price collar profit level). This profit target is set at the stock price collar profit level. The investor loses money as the price of the underlying asset goes beyond the stock price collar profit level.

The stock price collar trading strategy has several benefits and risks. One of the major benefits of this trading strategy is that it provides investors maximum profits while limiting downside risk. However, this strategy has its share of risks as well. A potential downside risk is volatility of stock prices, which can lead to large losses if the trader is not able to anticipate the movement of the market correctly. Another risk is option expiration, which can lead to large losses if short term put options expire worthless or long term call options expire exorbitantly expensive.

However, with proper research and analysis, a trader can use a stock collar option trading strategy to make money from investments in high- volatility instruments like stocks and equity derivatives like put options and call options.

Creating a Collar Position

A collar position is a position that involves the use of options and stock. A collar strategy involves buying stock shares at the market price and then selling call options to reduce the cost of investing in the stock and hedge the risk of price volatility.

The call option is cheaper than the stock and the call price is fixed, while the stock price goes up or down, call price follows the underlying stock. In short, a collar position is a position that combines call options and stock shares.

Before setting up a collar position with a broker or trading platform, it’s vital to understand the basics of options trading.

Research potential risks and rewards of a collar position before choosing a stock for your collar strategy.

Set up the collar position with a broker or trading platform according to your preferred method of investing.

Interpreting the Collar Option Strategy

The collar option strategy is a trading strategy that involves the purchase of call options and the sale of put options. The profit potential of the strategy is dependent on the price difference between the call option price and the underlying asset price, multiplied by the call option strike price.

The call option’s strike price is higher than the underlying asset price and its expiration date, while the put option’s strike price is lower than the underlying asset price and expiration date. Through this strategy, investors are able to profit from the difference in price between call options and underlying stock prices.

However, there are several risks involved with this trading strategy. Firstly, call options can expire worthless if a stock price doesn’t reach the strike price during expiration period of call options. Secondly, put options can expire worthless if a stock price exceeds the strike price of put options. Thirdly, stock volatility can make call options more expensive than put options in short periods of time, leading to losses. Thus, it is essential for investors to understand how the collar option strategy works and analyze their potential gains and losses with each trade before investing money into it.

Maximum profit

The collar option strategy is a combination of two options, a long call and short put. This strategy is most profit when the stock price rises above the strike price of the long call. At this point, the value of the long call is greater than its purchase price, resulting in a profit. However, if the stock price falls below the short put’s strike price, the loss would be equal to the difference between the purchase price of both option contracts. The collar strategy maximizes profit when stock price is above the long call’s strike price or below the short put’s strike price.

Maximum risk

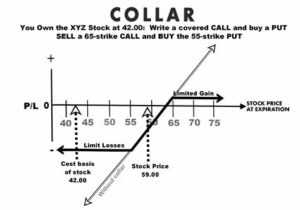

The collar option strategy is a risk management tool that combines the long stock position of an investor with the purchase of a protective put and the sale of a call. The protective put allows the investor to reduce potential losses if the stock price drops below the put price, while the call gives the investor the right to sell the stock at a price higher than the put. The collar option strategy thus has two options available: long stock position and short put or short call.

The maximum risk for this strategy is limited to the difference between strike prices of the purchased put and sold call, minus any premium received from selling the call. In other words, this strategy has a limited downside risk but also a limited upside potential. Investors should be aware of this before executing the collar option strategy.

Uses of the Collar Option Strategy

Collar options are a type of option strategy that can be helpful for investors looking to protect stock investments against volatility. The strategy involves investing in stock options with a collar — an option strategy where the price of the underlying asset is fixed at a price higher than the strike price plus the collar option amount. In this way, the profit potential of the underlying asset is limited to the collar option amount — but the upside potential of the option is unlimited.

The price of the underlying stock is then determined by the collar option price and volatility. With this strategy, investors can generate extra income from stocks while limiting their downside risk. Additionally, they can use collar options as a form of portfolio hedging, protecting their stock investments from downside volatility while still allowing some upside potential.

With collar options, there are many benefits to be had. It’s worth exploring and finding out more about this strategy and its potential benefits for your individual investing needs.

Frequently Asked Questions

What are the benefits of using a stock collar options trade?

A stock collar options trade is an options trading strategy that utilizes the purchase of put options to protect downside risk while simultaneously investing in call options to profit from upside potential. It is a great way for investors to benefit from the stock market without taking on too much risk.

The main benefits of stock collar options trades include downside protection, the ability to control losses if the market suddenly moves against you, the potential to take advantage of short-term market movements in either direction, and the potential for higher returns due to the lower amount of capital required in order to enter into a stock collar option trade. Additionally, it provides investors with an avenue to hedge their portfolio investments against potential losses. All these make stock collar options trades a great option for traders who want the potential for upside gains without exposing themselves too much risk.

Is it better to use an index or stock collar option for my options trades?

The answer to this question will depend on your investment goals and risk tolerance. If you are looking for an option that offers more diversification, the index collar option may be the better option for you as it provides less volatility than stock collar options. On the other hand, stock collar options can offer investors more control as they can customize the terms of the trade to their preferences.

Ultimately, investing in both index and stock collar options can provide a balance between diversification and control. This can help you to achieve your long-term investment goals while minimizing the volatility of stock price movements.

Is it possible to lose money on a stock collar options trade?

Yes, it is possible to lose money when trading stock collar options. This strategy involves the purchase of put option and call option contracts at the same time, and the potential loss of money can come from the expiration of the contract, changes in volatility of the underlying stock price, or the underlying asset price movement.

Thus, it is important to understand all the risks associated with stock collar options trading before entering into such a strategy. You should also research and use appropriate strategies when trading stock collar options in order to maximize returns while minimizing risk. With careful analysis of the various stock collar option strategies available, you can ensure that losses are kept to a minimum while still enjoying potential upside gains.

Is the collar a good option strategy?

The collar strategy can be a great option for investors who are looking to protect their stock position without having to sell the stocks just yet. This strategy involves buying a put option and selling a call option with the same expiration date. Doing this means that you will be covered in the case of downside risk while also limiting potential gains because the call option cannot exceed the strike price of the put option.

This strategy is usually used by long-term investors who want to make sure that their stock position is safe in the short term, but plan on holding the stock for longer periods of time. So if you’re looking for a strategy to protect your stock position without having to sell it off, the collar could be a good option for you.

Why would a trader put on a collar trade?

A collar trade is a strategy used by traders to limit their downside risk while still allowing for potential upside profit. This strategy involves buying a protective put option and selling a call option with the same expiration date. This helps protect the trader’s existing position from large drops in price, as the protective put option will offset the loss of the underlying stock if it goes down significantly.

The income generated from the sale of the call option can also help offset the cost of the protective put option, making this strategy even more beneficial to traders. This makes collar trades an attractive option for those who want to reduce downside risk while still having upside potential in the stock market.

Conclusion

A collar option strategy is a protective strategy that involves the purchase of a put option and the sale of a call option. It aims to reduce the risk of price fluctuations in an asset position. A collar option strategy can be used by investors to protect their long position in the stock from price volatility while still allowing them to profit if the price of the stock rises. The call option allows the investor to profit if the price of the stock rises, while the put option allows the investor to profit if the price of the stock decreases. Therefore, it helps reduce potential losses in your long position in the stock if price volatility occurs.