Calendar’s can be a good way to trade a range bound security.

A Calendar involves selling a short term option at a closer time frame and purchasing a longer term options at the same strike expiring a number of weeks/months later. You can place a calendar using either calls or puts. I usually  base which one to use based on:

base which one to use based on:

- The cost of the position, the lower the cost typically the better.

- What direction I think the underlying security might move if I am wrong about it being in a tight range. If I think it might go up, if it does not stay in the range, then I use calls. If I think it might go down, if it does not stay in the range, then I use puts. If you are using Calls your outlook is neutral to bullish. If you are using Puts your outlook is neutral to bearish.

I have a number of formulas I use to determine if a particular trade shows promise as a calendar. Most of them can be broken down into this simple statement. You want to sell more time than you are buying.

What does this mean?

When evaluating a calendar you need a short position that expires a number of weeks or months before your long position. I usually trade the next weeks expiring short and purchase a long 3 to 6 weeks after that. When I say you want to sell more time than you buy it means that you want the daily time value of the option you sell to be greater than the one you purchase.

Example: If next week’s option is trading for $1.00 and it expires in 7 days then the daily time value decay is $1.00/7 or $.14 per day. If the long option you purchase expires in 28 days and is trading for $2.00 then the time decay value of that option is $2.00/28 or $.07 per day. From a time decay stand point this option has potential as a calendar.

There is no ‘correct’ number of time decay difference I have found ‘magical’ I usually do not trade them unless the short is decaying 1.5 times as fast as the long and prefer if it is decaying over 3 times as fast. The one above is decaying 2 times as fast (.14/.07).

The other thing you need is a range bound stock or one you are reasonably sure is not going to jump either up or down very much on you. I try to stay away from overly volatile stocks and never trade calendars around earnings or other news releases. Also watch out for major market news such as interest rate changes.

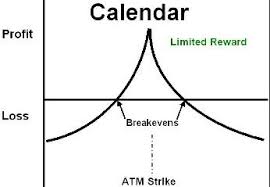

The biggest problem with a calendar is that a move in either direction causes you to lose money if it moves too much. It is OK for it to move against you before your short expires, but you need it to finish close to your short at expiration. I have had calendars that moved sharply against me but came back down close to my strike prices at expiration and I made money.

Your risk on a calendar is limited to the price you pay for the position. The max you can make depends on a number of factors and it is usually best to use a trade calculator to give you an idea what that is. Keep in mind that changes in volatility could theoretically affect the trade, but if you are trading a range bound security and it finishes close to your strike price it is unlikely volatility will have changed much. If volatility has changed a great deal you are probably at a loss anyway.