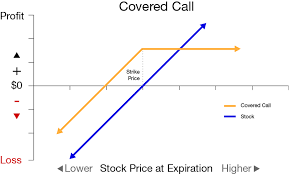

Covered calls are probably one of my most used trades. There are lots of different ways I enter one. The three most common are: Starting with a Naked or Cash Secured Put. Buying the stock and selling either a 50 or 70 delta call against it 21 to 45 days out. Buying the stock and […]

Category: Covered Calls

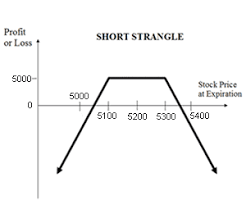

Covered Call Strangle Entry

Covered Call – The Strangle Entry When people learn option trading strategies they typically start with the old faithful of option trading strategies, the covered call. Trading a covered call option strategy is one of the foundation option trading strategies that everyone learns. But, what some people do not realize is that a covered call […]

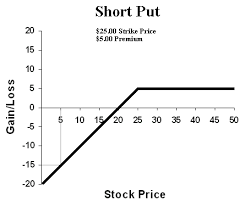

Covered Call Naked Put Strategy

The Covered Call Naked Put Strategy There are a lot of ways to get into a covered call trade. We actually prefer to use Diagonals but there is another way that can be very profitable if properly traded. If you trade options for profit or stocks for profit you need to know the best ways […]

What is the Best Type of Covered Call Trade?

What is the Best Type of Covered Call Trade? This is kind of a trick question because we believe the best type of Covered Call trade is not a Covered Call at all. We prefer to trade Diagonal Option positions instead of a traditional Covered Call. Let’s start with what is a Diagonal Call trade, […]

SRPT Covered Call

I was in this trade much longer than usual. Started it on 11/11/16 with SRPT trading at $40.01. I saw the stock drop as low as $27.75 during the trade but I stayed in it. Normally I would have closed with a stop loss but SRPT and I are old friends and I have ridden […]

Diagonals

What is a diagonal option trade? A diagonal is when you purchase calls or puts with different strike prices and expiring at different times. Examples: Purchase a $75.00 call expiring in 6 weeks and sell a $70.00 call expiring in 2 weeks. Purchase a $40.00 put expiring in 2 months and sell a $45.00 put […]