Covered Call – The Strangle Entry

When people learn option trading strategies they typically start with the old faithful of option trading strategies, the covered call. Trading a covered call option strategy is one of the foundation option trading strategies that everyone learns. But, what some people do not realize is that a covered call option trading strategy is not the best when it comes to risk and return.

Both of which are very important in option trading strategies.

Just in case you don’t know a standard covered call strategy consists of purchasing a stock and selling a call option against it for premium. Depending on your risk tolerance and prefers the short call you sell could be slightly in the money, at the money or out of the money.

The problem with a standard covered call strategy is the investment and by default the return on investment.

Example of a Covered Call:

If MSFT is trading at $105.25, you purchase 100 shares for $10,525.00 and sell the slightly in the money $105.00 call expiring in 30 days for $2.70 ($270.00) you receive $2.45 ($245.00) in premium.

You received $2.45 instead of $2.70 because the call was $.25 in the money.

If MSFT finishes right at $105.25 in 30 days then your shares are called away and you keep your $245.00. Which is a return of 2.3% over 30 days. Not bad? Well we don’t like that return.

There are three (at least) BETTER ways to enter a covered call trade in our opinion.

One is the Diagonal Option trade. We have blogged about it previously. CLICK HERE to see what a diagonal option spread is.

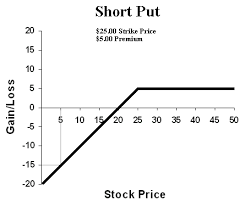

Another is entering a covered call by selling a Naked Put. We have blogged about this type of entry in the past also. CLICK HERE to learn about the naked put covered call entry.

also. CLICK HERE to learn about the naked put covered call entry.

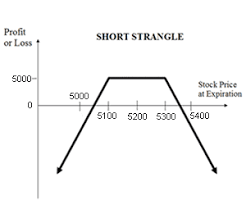

The one we want to discuss today is the Covered Call Strangle entry. It is very similar to the Naked Put entry but you also have a naked call to bring in more premium, and yes increase your risk to the upside. There is no reward without risk.

Let’s talk a minute about stock selection when using either the naked put or strangle entry to get into a covered call. Because we are ok with actually owning the underlying stock in this type of trade we need to pick stocks that we thing are good stocks.

You can get better premium trading strangles on high volatility stocks, but that is an income option strategy. We are using strangles here as a potential covered call entry which is a different type of option strategy.

When we think about using naked puts to strangles to enter a covered call option trade we typically thing about stocks like DIS, MSFT, V, NKE or other more stable stocks. Not pharmaceuticals and not stocks with earnings being released before our options expire.

We do not necessarily want a lot of volatility even though that does increase the option value when we sell them. If you are trading with a higher volatility then I would sell strike that are further out of the money. We might not mind owning these stocks at a discount but we would rather just keep selling strangles.

A naked put strategy for entering a covered call trade is all about entering the stocks at a discount. Therefore using a strangle to enter a covered call trade is all about getting the stock at a bigger discount.

But, in the strangle entry you do have to defend the short call. You do not want that to be assigned. We would typically close this trade if our strangle went against us on the up side by twice what we could have made on the strangle itself. Of course, you have to decide what your risk tolerance is.

typically close this trade if our strangle went against us on the up side by twice what we could have made on the strangle itself. Of course, you have to decide what your risk tolerance is.

On the downside, we do not mind if we get assigned. Remember in this type of options strategy we are going into it saying we don’t mind owning this stock to sell covered calls against if we can get into it at a discount.

Let’s compare the numbers to the MSFT trade we described above where we got a 2.3% return.

This time with MSFT trading at $105.25 we are going to sell the $110.00 call for $.85 ($85.00) and the $100.00 put for $1.10 ($110.00) or a total of $195.00. Because this is a credit we have out money going out. However, there is a reduction in buying power in your account to make sure you can cover this trade. This varies based on the spread and volatility. When we entered this trade ours was about $1,800.00.

So, if MSFT finishes between $100.00 and $110.00 in 30 days we just keep our premium of $195.00 or a return of 10.8% over 30 days.

If MSFT begins to move up toward our $110.00 short call we would probably close this trade at either 100% loss or 200% loss like we said above. Up to you how you close. What is your risk.

At 100% loss we would close the trade when we are showing a loss of $195.00 to the upside.

At 200% loss we would close the trade when we are showing a loss of $390.00 to the upside.

Keep in mind every day that goes by that MSFT is between $100.00 and $110.00 helps you as time decay reduces the value of the options you shorted.

If MSFT begins to move down toward $100.00 we would do nothing. In this type of covered call option strategy getting assigned the stock is not a problem.

If we get assigned at $100.00 then our investment in MSFT would be $100.00 minus our total option premium of $1.95. We would have $98.05 invested in MSFT. Remember when we entered this trade MSFT was trading at $105.25 so we essentially bought a good stock at a 6.8% discount and can now sell covered calls against it.

If we were doing a standard covered call we would have already lost $720.00 per 100 shares if he had owned the stock while it dropped from $105.25 to $98.05.

We hope our Covered Call Strangle Entry article has helped you better understand how strangles work and given you some better insight to better ways to trade a covered call option strategy.

Please comment below if you enjoyed our article or have any questions.