I want to discuss a strategy I really like on dividend paying stocks. I especially like the strategy on high dividend income stocks if I can make the numbers work.

First let’s discuss JEPI. It pay a monthly dividend of $57.00 which is about 11.42% annualized. It is a premium income fund, I actually own it in my long term investing accounts already.

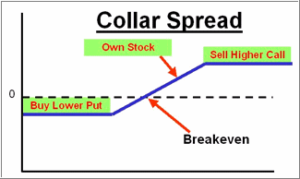

What I want to do is design a trade that reduces my risk in owning JEPI and still let’s me keep the dividends and accumulate a long term position.

Because I think JEPI will continue to move down, it isn’t overly likely it will get called away early (it could) which is the main risk with the position I am setting up.

Here is the position:

BUY 100 shares of JEPI @ $55.70

SELL the July 21, 2023 $56.00 Call for $1.10

Buy the July 21, 2023 $51.00 Put for $.85

At first glance it would appear my maximum gain if the JEPI stays the same or goes up is $55.00 or 0.98% for six months which is bad.

It also appears my maximum loss would be $455.00 because of my $51.00 PUT.

However, let’s not forget about the dividends of about $57.00 per month for the next 6 months. If I collect all of them that is $342.00 in dividends.

That means my maximum gain if JEPI is above $56.00 on July 21, 2023 is now $397.00 or 7.12% for six months. That is 14.24% annualized.

My max loss if JEPI is trading below $51.00 on July 21, 2023 is now $113.00. BUT, I still have the stock and can restart the trade lower down.

What is the real risk for this trade? If JEPI spike higher and my shares are called away early then I could lose the cost of my $51.00 Put which is $85.00. So, really this is a great trade.

If JEPI falls all the way to $25.00, I still just lose $113.00 and will sell another Call and buy another Put while collecting my dividend.