Reaping Low Volatility Profits with an Iron Condor Options Trade

Iron condors are options spreads that bear a resemblance to iron flies. Both options strategies profit from low volatility in the underlying stock. An iron fly is bearish  strategy that targets short put options, while an iron condor is a bear spread that involves short put options as well as long call options. Just like iron flies, iron condors are credit spreads, meaning they are entered with a net debit and profit if the price of the underlying stock remains constant or rises. Unlike iron flies, iron condor options trades profit from volatility being low. Iron condor options trades typically have maximum risk and reward that are identical, unlike iron flies where maximum loss is much bigger than maximum profit. This blog will cover everything about iron condors: what they are, when to use them, how to put them on and take them off, time decay and volatility impact on them, and much more.

strategy that targets short put options, while an iron condor is a bear spread that involves short put options as well as long call options. Just like iron flies, iron condors are credit spreads, meaning they are entered with a net debit and profit if the price of the underlying stock remains constant or rises. Unlike iron flies, iron condor options trades profit from volatility being low. Iron condor options trades typically have maximum risk and reward that are identical, unlike iron flies where maximum loss is much bigger than maximum profit. This blog will cover everything about iron condors: what they are, when to use them, how to put them on and take them off, time decay and volatility impact on them, and much more.

What Is an Iron Condor?

– An iron condor is a type of options trading strategy that uses long and short puts and calls with strike prices spread out over four different price points.

– A bearish iron condor involves purchasing call options with strike prices below the underlying asset’s price, while a bullish iron condor involves purchasing put options with strike prices above the underlying asset’s price.

– The iron condor is a lower-risk option trading strategy than the iron butterfly as all strikes are far-out-of-the-money, with lower potential profit.

– With an iron condor, maximum profit potential is limited to breakeven or slightly above it, whereas with an iron butterfly, maximum profit potential is much higher.

However, both strategies have their advantages and disadvantages. If you are new to options trading and want to learn more about it, an iron condor may be a good option for you.

Understanding an Iron Condor

An iron condor is a volatility trading strategy that’s designed to profit from volatility. In short, it involves buying options with strike prices between two of the price extremes of an underlying asset. The strike price of the out-of-the-money put option is below the current price of the underlying asset, and that of the out-of-the-money call option is above it. This way, if volatility rises, both options expire worthless, limiting risk and profit potential. However, if volatility falls, both options expire in profit and limit loss. With limited profit potential but limited loss, an iron condor offers a low-risk trading strategy with limited profit potential but limited loss.

The strategy includes buying one out of the money put option with a strike price below the current price of the underlying asset and selling one out of the money call option with a strike price above the current price of the underlying asset.

This way, it protects against significant moves in either direction by using high and low strike options called ‘wings.’

Thus, you can call an iron condor a volatility trading strategy that limits risk yet provides limited profit potential and limited loss.

Entering an Iron Condor

An iron condor is an options strategy consisting of two calls and two puts. It is a spread trading strategy created by selling a call option and buying a call option with the same strike price but with different expiration dates. This involves selling an out-of-the-money call option and buying a further out-of-the-money call option, all with the same maximum profit potential.

When closing the contracts within an iron condor, it is vital to consider not only the maximum profit potential but also potential loss. For example, if there is movement in stock price, one of the options may expire worthless, resulting in a loss of the premium paid for that option. So it is essential to close contracts before expiration to protect gains or minimize losses.

Exiting an Iron Condor

An iron condor is a trading strategy used in options trading where call options are spread across two strike prices and put options are spread across two expiration dates.

The call strike price option is purchased for a price above the call strike price and put strike price, while the put strike price option is purchased for a price below the put strike price and call strike price. In short-term options trading, iron condor strategies can be used to profit from volatility caused by short-term price swings.

When used properly, iron condors offer maximum profit potential with limited risk when compared to trading options without spreads. However, if the underlying stock price is beyond the long option at expiration, iron condor strategies can be exited with limited loss. Strictly speaking, iron condor strategies allow maximum profit potential with maximum risk as well; break-even points can be determined by total credit received (how much credit you receive on both sides of the spread).

Time decay works to the advantage of iron condors as they allow investors to profit from short-term volatility without having to hold long-term positions.

If the underlying stock price is within neither option’s strike price at expiration, time decay and time value of both call and put options will reduce profit potential of an iron condor position. If you are trading options on stocks that have short volatility periods, then an iron condor strategy may be a good option for you.

Time decay impact on an Iron Condor

The iron condor option strategy is a low-risk, profit-generating trading strategy aimed at providing traders with maximum profit potential when volatility is subdued. The iron condor involves buying an option strike price of one stock and selling another strike price that is either higher or lower than the first one.

The long option position has negative time decay, which means it loses value as expiration approaches. As expiration approaches, time decay will significantly impact the profitability of long options, making it more advantageous to short options.

Short options have positive time decay, which means they make money due to time erosion. In short options, time decay tends to offset any loss incurred from stock price volatility. By shorting options with a short iron condor, traders can potentially earn higher profits as volatility remains low over an extended period of time.

Implied volatility impact on an Iron Condor

– An iron condor is a trading strategy that benefits from decreases in implied volatility.

– In this strategy, the trader enters a put option position and two call options positions with strike prices B and C, respectively. The call options are used as profit targets and the put option positions are used to hedge the risk of the call options.

– When volatility rises, the price of call options increases, making put options more expensive. This causes the put option position to become short-terminated, or profitable for the trader. However, the call option position becomes long-terminated and loses money as volatility declines. As a result, volatility impacts an iron condor in different ways depending on where the stock is relative to strike prices B and C. Ideally, implied volatility is higher when the iron condor is initiated than at exit or expiration.

Adjusting an Iron Condor

An iron condor is an options trading strategy that involves buying call options on a stock with a strike price below the current market price and selling call options with a strike price above the market price. It is one of the most popular volatility trading strategies among options trading beginners.

An iron condor can be adjusted by extending the time horizon of the trade or by rolling one of the spreads up or down as the price of the underlying stock moves. Adjusting an iron condor will typically bring in more credit, which increases the maximum profit potential, decreases the maximum risk, and widens break-even points. However, contract size and expiration dates must remain the same to maintain its original position’s risk profile. If one side of an iron condor is challenged as contracts approach expiration, an investor can roll out the position to a later expiration date or roll one of the credit spreads towards stock price.

Iron Condor Profits and Losses

An Iron Condor involves trading call spread and put spread simultaneously on the same underlying asset. The call spread occurs when you buy the stock at a price below the strike price of the call option, whereas the put spread occurs when you sell the stock at a price above the strike price of the put option.

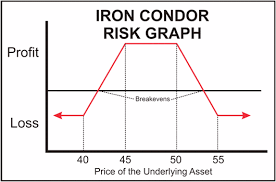

The maximum profit for an iron condor strategy is obtained when the price of the underlying asset stays between the middle strike prices at expiration. This maximum profit is equivalent to maximum theoretical loss of call spread + put spread – credit received for selling strategy = minus call spread + put spread – net debit < .

For example, if call spread = $1 and put spread = $2, then maximum profit is $0.50 ($2-$1) + $0.50 ($-1-$2) = $0.50.

Likewise, maximum loss for iron condor is maximum loss of call spread + put spread – credit received for selling strategy = minus call spread + put spread – net debit < . A reverse iron condor has different profit and loss characteristics from traditional iron condor.

A call spread of $1 and a put spread of $2 yields break-even point of $0.50 ($1-$0.50) + $0.50 ($-2-$0.50).

Are Iron Condors Profitable?

Iron condors are a trading strategy used to profit from low volatility in the stock market. This strategy involves betting on price movement between two strike prices at expiration. The middle strike price is where the price of the underlying asset will be if the options expire worthless.

– An iron condor guarantees maximum profits, provided the price of the underlying asset remains between the middle two strike prices at expiration. This means that an iron condor trader only needs to worry about the price movement of the underlying asset, not those of options.

– An iron condor trader can enter and exit an iron condor at any point during expiration as long as price movement of the underlying asset stays within that range.

– This strategy is different from an iron butterfly in which both strike prices are put options with different strike prices and premiums.

– Iron condors and iron butterflies have their merits, but they also have their shortcomings, such as high trading fees and time decay of profits.

– Reaping maximum profits with an iron condor options trade requires a thorough understanding of these strategies, as well as experience trading on volatility.

Frequently Asked Questions

Are iron condors a good strategy?

When trading iron condors, it’s important to look at the underlying stock price at expiration. If the price of the stock remains between the short strike prices of the iron condor option spread, then the strategy can be a profitable one. This strategy is beneficial because it allows you to profit from decreased volatility in the options market.

It is recommended to set up an iron condor spread after a volatility event known as an “IV crush.” This means that implied volatility drops significantly over a short period of time and provides more profit potential for the trader.

An iron condor strategy requires little to no movement in the underlying stock price over time to profit, which makes it an effective way to harvest low volatility profits. Ultimately, an iron condor strategy can be a good option for traders who are looking to make money without taking long-term risks or needing significant stock price movements.

How do you make money with an iron condor?

Making money with an iron condor options strategy involves selling two out of the money options and buying two further out of the money options to form a spread. The profit potential of an iron condor is determined by the credit received when the spread is opened, with higher credit corresponding to a larger maximum profit potential. Generally, maximum profit potential is realized when the underlying security price remains between the middle two strike prices of the spread. When this happens, maximum profit is equal to the credit collected when opening the spread. Losses can be incurred if the price of underlying security breaches any of the strike prices of options sold in the spread.

Conclusion

You’ve learned that options trading is a powerful way to profit from price movement potential in any market or stock. You also learned that condor options strategies, such as iron condor options trading, are flexible and can be used by traders at any skill level to profit from price movement potential. And you also found out that iron condor options trading allows you to profit when the price of an underlying asset (such as stocks or a currency pair) doesn’t move much. If you want to learn more about iron condor options trading, read this blog on iron condor options strategy profit potential.