Synthetic Long Stock

As part of my ongoing option strategy education I wanted to discuss a Synthetic Long position.

A synthetic long is very useful if you want to purchase a stock but do not have the capital to purchase it outright.

RISK: Keep in mind you have the SAME risk to the down side as if you had actually purchased the stock.

Example:

Let’s say you wanted to purchase 100 shares of Apple (AAPL) trading at 288.68.

If you wanted to purchase the stock itself you would have to pay $28,868.00 for 100 shares.

Another option, the Synthetic long, would be to buy a Call and Sell a Put at the same Strike (price).

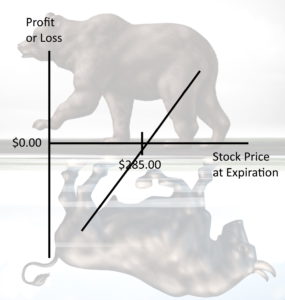

In our AAPL example we would probably purchase the $285.00 Call and sell the $285.00 Put. We need to choose a date at least 30 days away. In this example we are going 56 days out.

What does it cost?

$285.00 Call is priced at $13.60

$285.00 Put is priced at $9.75

This means we could purchase the $285 Call for $1,360.00 and sell the $285.00 Put for $975.00 for a net debit of $385.00.

As you can see, we now control 100 shares of AAPL for $385.00 instead of $28,868.00. Not bad.

Now there are a couple of things to keep in mind.

- Although you only paid $385.00 you will have to keep cash in your account to secure this trade. When I entered it my brokerage company required me to keep $6,800.00 to cash secure the Put.

- You risk is almost exactly the same as if you purchased 100 shares of the stock. Meaning if AAPL went to $0.00 you would still lose about $29,000.00.

Synthetic longs are not terrible trades is you are considering purchasing the stock itself.

However, there are much better lower risk strategies in my opinion. But, every once in a while I will use this strategy.