Stock options are a powerful financial instrument that can offer both high rewards and significant risks. Understanding the basics and terminology of stock options is essential for anyone interested in trading or investing in this complex market. In this comprehensive guide, we’ll explore what stock options are, how they work, and the key terms you need to know to navigate this exciting arena effectively.

What Are Stock Options?

Stock options are financial contracts that give investors the right, but not the obligation, to buy or sell a stock at a predetermined price within a specified period. They are commonly used by traders to hedge against potential losses, speculate on stock price movements, or enhance portfolio returns.

There are two main types of stock options: call options and put options.

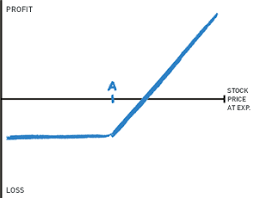

- Call Options: These give the holder the right to buy a stock at a specific price (known as the strike price) before the option expires.

- Put Options: These give the holder the right to sell a stock at the strike price before the option expires.

Key Terminology

Understanding stock options involves becoming familiar with several key terms. Here’s a breakdown of the most important terminology:

- Strike Price (Exercise Price): The price at which the holder of the option can buy (for call options) or sell (for put options) the underlying stock. This price is set when the option is purchased.

- Expiration Date: The date by which the option must be exercised. After this date, the option becomes void and worthless if not exercised. Options typically have expiration dates ranging from a few weeks to several months.

- Premium: The cost of purchasing an option. This is the price paid upfront by the buyer to the seller (writer) of the option. The premium is influenced by factors such as the stock price, strike price, time until expiration, and volatility.

- In-the-Money (ITM): An option is in-the-money if it would lead to a profit if exercised immediately. For call options, this means the stock price is above the strike price. For put options, it means the stock price is below the strike price.

- Out-of-the-Money (OTM): An option is out-of-the-money if exercising it would not be profitable. For call options, this means the stock price is below the strike price. For put options, it means the stock price is above the strike price.

- At-the-Money (ATM): An option is at-the-money when the stock price is equal to the strike price. This means there is no intrinsic value, but the option may still have time value.

- Intrinsic Value: The difference between the stock price and the strike price of an option, if favorable. For call options, it’s the stock price minus the strike price. For put options, it’s the strike price minus the stock price. If this value is negative, the intrinsic value is zero.

- Time Value: The portion of the option’s premium that exceeds its intrinsic value. It reflects the possibility that the option could become more valuable before expiration due to changes in the stock price, time decay, or volatility.

- Volatility: A measure of how much the stock price is expected to fluctuate. Higher volatility increases the potential for significant price movements, which can affect the option’s premium.

- Delta: A measure of how much the price of an option is expected to change when the price of the underlying stock changes by one dollar. For example, a delta of 0.5 means the option price will likely change by 50 cents for every dollar change in the stock price.

- Gamma: The rate of change of delta as the stock price changes. Gamma helps traders understand how delta will change in response to movements in the stock price.

- Theta: The rate at which an option’s time value decreases as the expiration date approaches. Theta quantifies time decay, meaning the value of an option decreases as time passes, assuming other factors remain constant.

- Vega: A measure of an option’s sensitivity to changes in the volatility of the underlying stock. A higher vega indicates that the option’s price is more affected by changes in volatility.

- Rho: The measure of an option’s sensitivity to changes in interest rates. It shows how much the price of an option is expected to change in response to a one-percentage-point change in interest rates.

How Stock Options Work

To understand how stock options work, let’s break down a typical option transaction.

- Purchasing an Option: When you buy an option, you pay a premium to acquire the right to buy (call option) or sell (put option) a stock at a predetermined price. This premium is paid to the option seller (writer).

- Exercising an Option: Exercising an option means using the right to buy or sell the underlying stock at the strike price. For call options, you would buy the stock at the strike price. For put options, you would sell the stock at the strike price.

- Selling an Option: Instead of exercising an option, you can sell it to another investor before the expiration date. This is known as closing the position. The value of the option will depend on factors like the stock price, time until expiration, and volatility.

- Expiration: If an option is not exercised or sold before its expiration date, it becomes worthless. This is why timing is crucial in option trading.

Types of Options Strategies

There are numerous strategies involving stock options, each with its own risk and reward profile. Here are a few common strategies:

- Covered Call: Involves holding a long position in a stock and selling a call option on the same stock. This strategy generates income through the option premium but

limits potential upside.

limits potential upside. - Protective Put: Involves holding a long position in a stock and buying a put option on the same stock. This provides downside protection by allowing you to sell the stock at the strike price if its value falls.

- Straddle: Involves buying both a call and a put option with the same strike price and expiration date. This strategy profits from large price movements in either direction.

- Iron Condor: Involves selling a call and a put option at one strike price while buying a call and a put option at higher and lower strike prices, respectively. This strategy profits from minimal price movement and high time decay.

- Vertical Spread: Involves buying and selling call options or put options at different strike prices but with the same expiration date. This strategy can limit potential losses while still allowing for potential gains.

Risks and Considerations

Trading stock options involves several risks, including:

- Market Risk: The risk of losing money due to unfavorable movements in the stock price.

- Leverage Risk: Options can amplify both gains and losses due to their leverage. Small price movements in the stock can lead to significant changes in the option’s value.

- Time Decay: The value of options decreases as the expiration date approaches. If the stock price doesn’t move as expected, the option can lose value over time.

- Volatility Risk: Changes in the stock’s volatility can impact the option’s premium. Increased volatility can raise the option’s price, while decreased volatility can lower it.

- Liquidity Risk: Some options may have low trading volumes, making it difficult to buy or sell them at desired prices.

Conclusion

Understanding the basics and terminology of stock options is crucial for anyone looking to trade or invest in these financial instruments. By familiarizing yourself with key terms like strike price, expiration date, and intrinsic value, as well as grasping how options work and the various strategies available, you can make more informed decisions and manage the associated risks effectively. As with any investment, it’s important to do thorough research and consider seeking advice from financial professionals to tailor your approach to your specific goals and risk tolerance.