Iron condors are a favorite of mine. I typically only trade them on indexes such as RUT, SPX and NDX. I prefer SPX because I have found it trades more predictable to me. I seem to run into  problems more often with RUT and NDX. That is not to say I do not trade them, just that I prefer the SPX.

problems more often with RUT and NDX. That is not to say I do not trade them, just that I prefer the SPX.

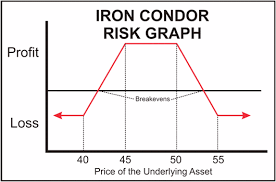

An iron condor is a range bound strategy consisting short calls and puts and long calls and puts. Your outlook with a condor is direction neutral. You enter into an iron condor with a net credit. You need the security you are trading to stay within your short calls and puts. The long calls and puts are just to reduce your risk and margin requirements.

An iron condor has an identifiable maximum profit and maximum risk when you enter the trade, that is another good thing about them. I really do not mind having a capped profit potential if the returns are where I need them. The main thing I always try to get is a capped risk.

One strategy with an iron condor is to wait for expiration and keep all your initial credit. I go back and forth on that, right now I like to decide what return I need and put in a GTC order. When it hits, I get out.

About half the time I start an iron condor as an iron condor, most of the time I start with a put or call credit spread and then attempt to complete the other side to end up with my condor. If I do not get the fill I want on the second part of the condor, not a problem I just trade my credit spread.

I do have some rules I try and follow when setting up an iron condor.

- I like the delta of my short position to be 10 or less.

- It is better to start your condor when volatility is high. You will actually make money as the volatility goes down.

- Need at least 49 days until expiration but prefer no more than about 62. On a standard iron condor. I do trade some shorter term iron condors from time to time but they are not part of my primary iron condor strategy.

- It is better if you can see clear support and/or resistance on the chart protecting your positions.

- Normally I just trade indexes.

When to adjust.

- I typically try to adjust if the delta of one of my short positions goes above 30.

- If the price gets too close to my short options. I cannot give you exactly what that number is because it is different depending on the security.

Overall, iron condors are a good way to make a fairly predictable return. They also have the advantage of being easier to adjust or defend if necessary in most normal market conditions. Trading the more conservative rules above I have only ran into a problem once when my Call were threatened, I have found it can be difficult to defend the call side of a trade as opposed to the put side.