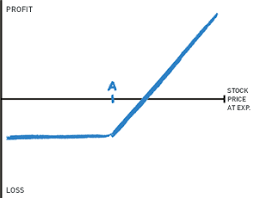

The Long Call The long call is one of the most basic option strategies you can use when trading options. It is relatively simple and easy to understand, however most people forget about the effect of Delta on the position. When purchasing an option, I like to have AT LEAST 30 days before expiration. Preferably, […]