DIA – 9/4/18 – Iron Condor I started this trade with DIA trading at 259.18 and it did not go as smoothly as some of my others. On 10/3 I was considering rolling this trade out another month or closing for a small profit. In the end I decided to hold and let the probabilities […]

Author: Jim Dawson

2/1/2019 Weekly Recap and Look Forward

2/1/2019 Weekly Recap and Look to Next Week The market moved up fairly sharply because of no reference to future interest rate increases and a good corporate earnings week. Last week we were able to close a couple of our Short Butterfly’s for target profit and entered into a couple of more. We have been […]

EWZ – 9/4/18 – Broken Wing Iron Condor

EWZ – 9/04/18 – Broken Wind Iron Condor I took this trade out the same day I did the EWZ trade above. I traded it as a comparison to different strategies and risk/reward expectations. Both trades were profitable (this time) I typically don’t trade the same security with two different strategies at the same time […]

CELG – Long Call – 7/13/18

CELG – 7/13/18 – Long Call CELG had been in a sideways move after a down trend. I watched it move up then retrace just above weekly support and decided to purchase the $80.00 Calls expiring on 9/21/18 with CELG trading at $85.51. My initial mental target was $87.58 with my stop around $83.47. […]

What are Fibonacci Levels

What are Fibonacci Levels Fibonacci lines are a very popular tool technical investors use to determine potential price action. They use them to help find support and resistance points. In fact, they may very well be the most popular of all trading tools. We know there are many people that do not believe in Fibonacci […]

PCAR – Long Call – 7/12/18

PCAR – 7/12/18 – Long Call On 7/12 I noticed and evening start pattern on the PCAR chart and decided to traded it. I purchased an ITM Put option with a Delta of 71 so I would make money a little faster if the stock continued down. I had to pay a little more for […]

Does Robot Trading Work?

Does Robot Trading Work? Don’t like to read? See the YouTube video by CLICKING HERE Everyone wants an easy way to make money trading securities. We want an automated process that requires no thinking on our part. Just plug and play like the rest of our lives. Why does Robot Trading appeal to People? Fear […]

CELG – Covered Call – 7/31/18

CELG – 7/31/18 – Covered Call This is a standard covered call I entered in CELG. You will notice on the chart below how the price changed over the 37 days I was in the trade and how I defended my short Calls. The only mistake I made was on 8/31 I was going to […]

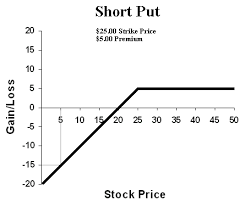

Covered Call Naked Put Strategy

The Covered Call Naked Put Strategy There are a lot of ways to get into a covered call trade. We actually prefer to use Diagonals but there is another way that can be very profitable if properly traded. If you trade options for profit or stocks for profit you need to know the best ways […]

ATVI – Covered Call – 7/6/18

ATVI – 7/6/18 This was another of a series of trades I did in ATVI as I tracked it through a number of different trades. This time I actually purchased shares of ATVI and entered into a standard covered call. With ATVI trading at $77.06 I bought 100 shares and sold a $77.00 call that […]