Learn Option Trading Strategies

Are you wanting to learn to trade stock options? Looking to learn option trading strategies that really work and are high probability?

If you want to learn options trading we can absolutely help you, with no monthly subscription and no huge upfront cost for learning options trading.

First of all let me start by telling you the types of trades we make. Most of our options trades are Iron Condors, diagonals, Butterfly’s and Strangles. If you want a more in depth idea about what those are, click on each of them to open another page that gives you more details.

Just to give you a quick idea about that the trades above are in case you don’t want to click on them for more research:

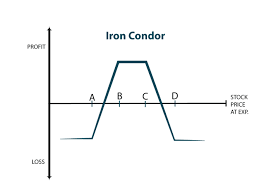

We sell Iron Condors using both a different options trading strategy on Indexes than we do on stocks.  Sometimes we do trade EFT’s using the stock Iron condor strategy.

Sometimes we do trade EFT’s using the stock Iron condor strategy.

We like to sell Iron Condors by selling an out of the money (OTM) Call and Put at a certain width and buying a Call and Put to ‘cover’ our short Call and Put which caps our risk with this options strategy and limits our potential profit to the net credit we received for selling the condor.

We use a rules based Iron Condor options strategy on Index’s and a probably based strategy on Iron Condors on stocks. They are actually somewhat similar when they are placed but the adjustments are different.

We use our Diagonal strategy as a modified Covered Call options trading strategy. We don’t like the traditional covered call strategy and can make a much higher return using a diagonal option spread trade than we can with a covered call and can do it at less risk.

To enter a long diagonal options spread we by a deep in the money, close to delta 1, option that expires at least 90 days for now if not longer. This is our replacement for purchasing the stock. We then sell calls against it for a couple of months or more like you would a regular covered call trade.

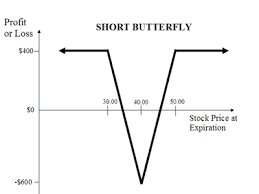

We sell and buy Butterfly’s using a probability model. When we sell a butterfly we buy an at them money (ATM) option and sell a higher and lower strike option to complete the short butterfly. You use a 1:2:1 ratio when making these trades meaning you want to buy/sell twice as many of the middle option as the higher and lower strike options.

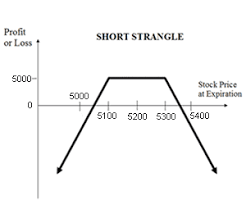

We typically sell strangles based on a probability model. We do have some adjustment/close rules we apply to these since they technically are uncapped risk. Our strangles have a lower net return than our other trades but a much higher probability of success.

We typically sell strangles based on a probability model. We do have some adjustment/close rules we apply to these since they technically are uncapped risk. Our strangles have a lower net return than our other trades but a much higher probability of success.

You sell a strangle buy selling an out of the money (OOM) Call and an OOM Put.

We also do a few debit spreads based on swing trading from time to time and are working on a brand new SPY strategy that we are still testing. Perhaps we will introduce it in time but it takes a while to vet any new option trading strategy.

How do we pick our stocks to trade?

For the Index based Iron Condor we prefer SPX so you will see us trade it over and over. If the trade starts to get in trouble we might sell a credit spread in NDX or RUT to hedge against the SPX trade.

Our probability based Iron Condors are typically the same group of stocks. We like to see if we can find the ones with spiking volatility and no earnings before the Iron Condor expires.

With Strangles you will usually find us trading the same groups of stocks as well. Sometimes because of earnings or really low implied volatility we have to mix it up but it is easier to watch a handful of stocks than all of them.

For Butterfly’s it depends on whether we are shorting them or going long. Lately we have been selling butterfly’s so we try to focus on very liquid stocks that have earnings coming up. Sometimes we will buy a butterfly if overall volatility is really low but lately we have not been a buyer.

Our Debit Spreads and sometimes our Iron Condors are based on trend lines, chart patterns, candle sticks and our swing trade indicator. You will normally see a lot of the same stock names that you see in our other trades since those are the ones we are watching.

Learning options trading takes time but we don’t think it should cost you a fortune. Yes, one day we may have a premium service that has a monthly cost involved because it does cost money to run a service like that properly, but right now we are just providing you with education.

How?

We have written five books that will give you the basic information on how we trade. No, they WILL NOT cost you a small fortune. Each between $2.99 to $4.99 for the ebook and a maximum of $9.99 for the paperback. We highly recommend the paperback because you can see the tables and reference them much easier. But, if you are an ebook person we have them on ebook.

So, our entire options trading course will cost you less than $50.00 for the paperbacks, less for the ebooks. How’s that for a deal. Search for other options trading courses and see if you find a better deal out there.

In addition you can find VERY valuable information about different strategies right here on our website including videos, yes all for free.

You can follow us on Twitter or Facebook and get real time commentary on what we are trading and what we are doing. Some weeks we are more active than others because we don’t just sit in of the computer all day every day.

We want to tell you a little bit about our books. Depending on your current options trading education you might not need the first one. But, if you want a refresher on options trading strategies or are new, we recommend you start with book one.

Book’s two and three are very special.

They are more that option trading strategy, they are also excerpts from our actual trades. That’s right, you actually get to see parts of our ACTUAL trading journals. You can tell they are real because we changed the way we set them up between book 2 and book 3. We found a better way to read the trade data. In fact, we have since changed our trade journal again so we can better keep up with starting probability and beginning and ending volatility.

Yes, trading is always evolving and so are we.

Below is a short description of each book and links where you can buy them. We really believe they will help you get started trading options for income and we know you won’t find the information on this website and in our books cheaper.

There is a good degree of repetition between Watch Me Trade 2 and High Probability Options. The primary thing we did different in High Probability Options was just focus on probability trades and added a lot about Strangles, included introducing our actual strategy for the first time. We just wanted you to be aware that there are many of the same trades in both those books. If you are just going to buy one of them I would suggest High Probability Options over Watch Me Trade 2.

Who knows one day we might even start up that premium subscription if enough of you want advanced training and see all of our trades in real time including strikes, expirations, probabilities and good to cancel (GTC) orders. Be sure to sign up for our NEWSLETTER to get updates on education and strategies, including our new SPY strategy if it goes live.

One word of caution whether you are following us trading options or someone else, make sure you understand option risk. Depending on the trades you can lose more than you invest. Some options strategies are more dangerous than others. Our Strangles are technically uncapped risk, the rest of our trades have a defined risk.

Trade4Profits – Shortcuts to Profitable Trading is our starter level book. This book is designed for new options  traders looking to learn the verbiage of successful stock option strategies. We also introduce some basic technical analysis skills that can we expand more on in other books and our website. We teach you value of option trading in generating a substantial return in all markets, but we prefer range bound in most of our option trading strategies. This book is a great starting point if you are new to stock option trading or a refresher course to keep you up to speed.

traders looking to learn the verbiage of successful stock option strategies. We also introduce some basic technical analysis skills that can we expand more on in other books and our website. We teach you value of option trading in generating a substantial return in all markets, but we prefer range bound in most of our option trading strategies. This book is a great starting point if you are new to stock option trading or a refresher course to keep you up to speed.

Trade4Profits – Watch me Trade is just what it says it is, you get to watch us while we make actual trades. You  can watch us trade Diagonal Spreads, Iron Condors, Butterfly’s, Covered Calls, Calendars, Debit Spreads and Credit Spreads. This is not just your standard trading book, you get to see our actual trades and see behind the scenes as we think through our decisions. You get to see our failures also. Yes, we do sometimes lose money trading options. A trader’s journal is the most important thing to their long term success as a trader; we are sharing ours with you.

can watch us trade Diagonal Spreads, Iron Condors, Butterfly’s, Covered Calls, Calendars, Debit Spreads and Credit Spreads. This is not just your standard trading book, you get to see our actual trades and see behind the scenes as we think through our decisions. You get to see our failures also. Yes, we do sometimes lose money trading options. A trader’s journal is the most important thing to their long term success as a trader; we are sharing ours with you.

Trade4Profits – Watch me Trade 2 is the follow up to Watch me Trade and has more Iron Condors and other  probability based trades in it that our first trade journal book. Both books give you information about why we make the trades and what the trades are supposed to do based on our analysis and probabilities. You can also see some changes we made to our trading journal from the first Watch me Trade book to this one. We have made more changes since then including more data like initial volatility, ending volatility and initial probability of success. Watch me Trade 2 is a trading journal like Watch me trade but it is also different because we focused on the probability based trades more than our other trades. We still make all the trades you see in both of the Watch me Trade books, but the amount and type of each trade changes as market conditions change.

probability based trades in it that our first trade journal book. Both books give you information about why we make the trades and what the trades are supposed to do based on our analysis and probabilities. You can also see some changes we made to our trading journal from the first Watch me Trade book to this one. We have made more changes since then including more data like initial volatility, ending volatility and initial probability of success. Watch me Trade 2 is a trading journal like Watch me trade but it is also different because we focused on the probability based trades more than our other trades. We still make all the trades you see in both of the Watch me Trade books, but the amount and type of each trade changes as market conditions change.

Covered Calls – You are doing it WRONG!

What if we told you everything you have been taught about writing Covered Calls is Wrong! What if we told you, you had been doing it wrong this entire time? Would you listen? Can we convince you there is a better way? If you can give us a short amount of your time we can show you how to get better returns, with less risk than writing your Grandfather’s traditional Covered Call. There are so many better options (literally) than there used to be to a traditional Covered Call. Let us tell you about them.

High probability options trading is all about trades that give you be best chances to be successful. We use Iron Condors, Broken Wing Iron Condors, Butterflys and Strangles to give us the best chances for successful trades based on current market conditions, option delta and volatility. We do not use chart patterns to enter trades, we use probability. We give you the rules we use, the points we make adjustments and where we try to close. We also give you examples of trades in our trading journal so you can get a look at how different trades actually play out. We don’t just tell you, we show you!

You can buy our books on Amazon (or by clicking on them above), you won’t find a less expensive options trading course than our books, Facebook page and free website. We can promise you that. You do need the two Watch me Trade books and/or the High Probability Options book to fully understand what we are doing on Facebook and see our how the strategies we give you on our website actually work.

Good luck, in your trading and please sign up for our NEWSLETTER to keep up to date the education and strategies we offer. We promise we won’t spam you with emails. The most we email is once a week, most of the time less depending on what we are adding to the website.

Remember, the MOST important thing about stock option trading is understanding your risk. Options can get you into trouble if you don’t. Also, always have a trading plan and trade your plan. You can modify your plan over time but try not to during the trade.