In a previous post I discussed the advantages of an deep in the money covered call. Yes, I know the overall returns are not as good as an at the money or out of the money covered call but as crazy as this market is I prefer the lower gains and added protection. DIS is […]

Better Way to Enter a Covered Call

Covered calls are probably one of my most used trades. There are lots of different ways I enter one. The three most common are: Starting with a Naked or Cash Secured Put. Buying the stock and selling either a 50 or 70 delta call against it 21 to 45 days out. Buying the stock and […]

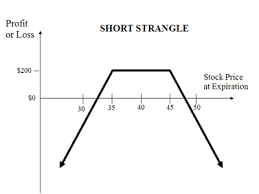

What is a Short Strangle and Why would you place one?

What is a Short Strangle and Why would you place one? It is important to understand how a short (naked) call and a short (naked) put work before you commit to placing your first strangle. Why? Well because a strangle is basically the same as selling either a short call or a naked put as […]

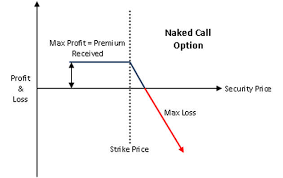

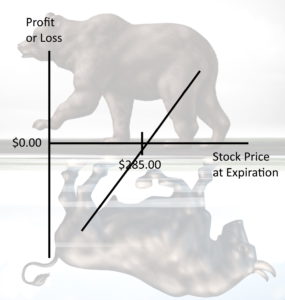

The Short (Naked) Call

The Short (Naked) Call Shorting or selling a call is the opposite of buying a call. When you buy a call you typically expect or want the underlying to go up in price since you have purchased the right to buy the underlying at a specific price. When you short a call you are giving […]

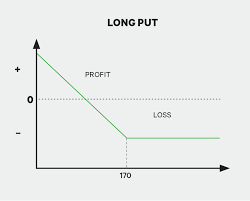

The Long Put

The Long Put The Long Put is another of the most basic of options strategies you can use when trading options. It is easy to understand and you know your risk when you enter the position. Most people do however, forget about the effect of Delta on the position. When purchasing an option, I like […]

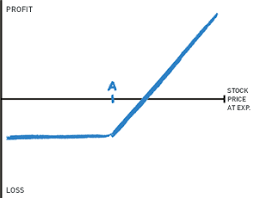

The Long Call

The Long Call The long call is one of the most basic option strategies you can use when trading options. It is relatively simple and easy to understand, however most people forget about the effect of Delta on the position. When purchasing an option, I like to have AT LEAST 30 days before expiration. Preferably, […]

Synthetic Short Stock

Synthetic Short Stock The only advantage of a synthetic short stock position over just shorting the stock itself is the margin requirements. It takes less margin to use a synthetic short stock position as compared to just shorting the stock. Another reason some people use a synthetic short is because mentally, they seem less scared […]

Synthetic Long Stock

Synthetic Long Stock As part of my ongoing option strategy education I wanted to discuss a Synthetic Long position. A synthetic long is very useful if you want to purchase a stock but do not have the capital to purchase it outright. RISK: Keep in mind you have the SAME risk to the down side […]

Bollinger Band Trading System

There are lots of strategies out there for trading stocks, we want to give you one for free just for signing up to our newsletter. You can unsubscribe anytime but we think you will enjoy the free training, strategies and trade ideas we share with you.

Covered Calls – You are Doing it WRONG!

Covered Calls – You are Doing it WRONG! What if we told you everything you have been taught about writing Covered Calls is Wrong! What if we told you, you had been doing it wrong this entire time? Would you listen? Can we convince you there is a better way? If you can give […]