Learn Option Trading Strategies Are you wanting to learn to trade stock options? Looking to learn option trading strategies that really work and are high probability? If you want to learn options trading we can absolutely help you, with no monthly subscription and no huge upfront cost for learning options trading. First of all let […]

Category: Education

What are Fibonacci Levels

What are Fibonacci Levels Fibonacci lines are a very popular tool technical investors use to determine potential price action. They use them to help find support and resistance points. In fact, they may very well be the most popular of all trading tools. We know there are many people that do not believe in Fibonacci […]

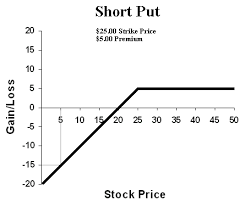

Covered Call Naked Put Strategy

The Covered Call Naked Put Strategy There are a lot of ways to get into a covered call trade. We actually prefer to use Diagonals but there is another way that can be very profitable if properly traded. If you trade options for profit or stocks for profit you need to know the best ways […]

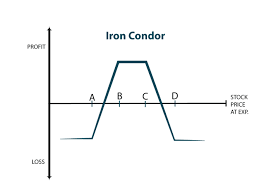

What is the Difference Between Buying and Selling an Iron Condor?

What is the Difference Between Buying and Selling an Iron Condor? Risk, reward and probability of success. Like most things in life the more risk you take the higher your potential reward but the lower chance of success. This is buying an Iron Condor On the other hand, if you take less risk your reward […]

What is the Difference between Buying and Selling a Butterfly

What is the Difference Between Buying and Selling a Butterfly? Simple, risk verses reward. I bet you wanted more than that right? Well, if you insist. Let’s take a couple of real life examples looking at the market right now. Let’s look at TSLA which is trading at $297.04 right now with an implied volatility […]

Relative Strength Index (RSI)

Relative Strength Index (RSI) The Relative Strength Index or RSI is a very popular technical indicator used by many traders. We like using RSI, not as much as MACD or more currently we have been using CCI a lot The idea behind the Relative Strength Index (RSI) is to give you an indication of the […]

MACD Divergence Strategy

MACD Divergence Strategy MACD (Moving Average Convergence Divergence) is a very popular trading indicator. It is in essence a trend following indicator that shows the relationship between two moving averages. The most used settings are the 12 period exponential moving average (EMA) and the 26 period EMA. The MACD value is calculated by subtracting the […]

Understanding Option Greeks

Do you know what Option Greeks are? Do not worry of you don’t most people either do not know what they are or think they are too difficult to understand to even try. Good news, they are not difficult at all. Further good news, the main one we use is Delta so you do not […]

How to Find the Right Stock to Swing Trade MA CCI

How to find the right Stock to Swing Trade MA CCI First of all, there are lots of different methods to finding a good stock to swing trade and from time to time we like to discuss various options. One our favorites is using two simple moving averages to determine a trend and the Commodity […]

52 Week High Trading Strategy #1

52 Week High Trading Strategy Are you looking for a new ideas about finding a trade? There are a number of different strategies revolving around stocks reaching a 52 week high. Today we want to discuss one that is worth taking a look at. Keep in mind we are not saying this strategy will work […]