Gold futures are one of my favorite things to trade. I prefer to sell premium as opposed to buy premium when I am trading gold options. Typically I use naked puts, naked calls or strangles. You can also use iron condors and credit spread is you prefer defined risk. Sometimes I will use spreads, but […]

Category: Education

Better Way to Enter a Covered Call

Covered calls are probably one of my most used trades. There are lots of different ways I enter one. The three most common are: Starting with a Naked or Cash Secured Put. Buying the stock and selling either a 50 or 70 delta call against it 21 to 45 days out. Buying the stock and […]

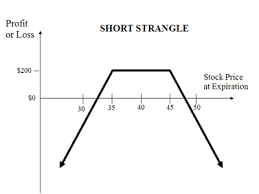

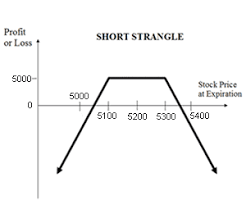

What is a Short Strangle and Why would you place one?

What is a Short Strangle and Why would you place one? It is important to understand how a short (naked) call and a short (naked) put work before you commit to placing your first strangle. Why? Well because a strangle is basically the same as selling either a short call or a naked put as […]

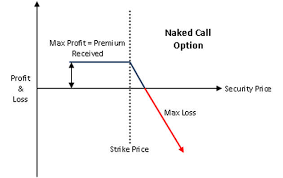

The Short (Naked) Call

The Short (Naked) Call Shorting or selling a call is the opposite of buying a call. When you buy a call you typically expect or want the underlying to go up in price since you have purchased the right to buy the underlying at a specific price. When you short a call you are giving […]

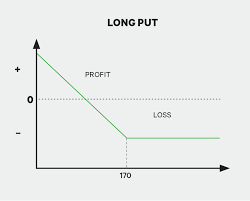

The Long Put

The Long Put The Long Put is another of the most basic of options strategies you can use when trading options. It is easy to understand and you know your risk when you enter the position. Most people do however, forget about the effect of Delta on the position. When purchasing an option, I like […]

Synthetic Short Stock

Synthetic Short Stock The only advantage of a synthetic short stock position over just shorting the stock itself is the margin requirements. It takes less margin to use a synthetic short stock position as compared to just shorting the stock. Another reason some people use a synthetic short is because mentally, they seem less scared […]

Synthetic Long Stock

Synthetic Long Stock As part of my ongoing option strategy education I wanted to discuss a Synthetic Long position. A synthetic long is very useful if you want to purchase a stock but do not have the capital to purchase it outright. RISK: Keep in mind you have the SAME risk to the down side […]

Personal Finance and Investing

PERSONAL FINANCE OR INVESTING The term personal finance means managing your money. It starts with saving your money and investing it in the right way. This includes making a well-planned budget, sticking to it, planning insurance, banking and managing all finances. Personal finance goes a long way as It starts as soon as you get […]

New YouTube Channel

Well, not exactly new. We are working hard to build our YouTube Channel. Our hope is to be able to provide you the education you need for FREE to trade the market. It does not matter if you trade stocks, options, forex or commodities we believe we have something to help you be more successful. […]

Strangles What Are they and How do We Trade Them.

Strangles – What are they and How do we Trade Them? Strangles are the only uncapped risk, limited reward strategy we trade. As a result we are highly selective about how we trade Strangles. We base our strangle trades like we place our probability based non-index and Broken Wing Iron Condors. We use probabilities and […]