EWZ – 9/28/18 – Iron Condor Looking to stay active I decided on an Iron Condor in EWZ on 9/28. Implied Volatility was at 79 and coming down from 100 so there was good premium still to be had. With EWZ trading at $34.14 I sold the 11/16 $40 Call and purchased the $43 Call. […]

Author: Jim Dawson

March 1st 2019

3/1/19 Weekly Recap and Look to Next Week We got our pull back this week bottoming out on Wednesday. We entered a SPY test trade off the bounce which we are still in. Closed half for profit and moved rest to break even. Butterflys We closed 2 of our butterflys this week for profit. We […]

CRM 9/28/18 Iron Condor

CRM – 9/28/18 – Iron Condor I have always struggling trading CRM, not sure why I keep trying. The return here looked pretty good, I guess that is one reason I keep trying to trade it. On 9/28 I entered into a 11/16 Iron Condor selling the $175 Call and purchasing the $180 Call. I […]

CC

Covered Calls – You are Doing it WRONG! What if we told you everything you have been taught about writing Covered Calls is Wrong! What if we told you, you had been doing it wrong this entire time? Would you listen? Can we convince you there is a better way? If you can give us […]

HPO

High Probability Options High probability options trading is all about trades that give you be best chances to be successful. We use Iron Condors, Broken Wing Iron Condors, Butterflys and Strangles to give us the best chances for successful trades based on current market conditions, option delta and volatility. We do not use chart patterns […]

February 22nd 2019 Weekly Review and Look Forward

2/22/2019 Weekly Recap and Look Forward We only got a small pullback on Thursday. We expected more but it appears this is a consolidation for a move. Butterflys We only closed one of our Butterflys last week for a small profit of just over 6%. We are still in the rest and the majority are […]

TLT 9/25/18 Broken Wing Iron Condor

TLT – 09/25/18 – Broken Wing Iron Condor I got on a little bit of a habit of placing these Broken Wing Iron Condors during this time period. Great if you are expecting the market to move a certain direction, but don’t over do them. If the market suddenly changes on you and you are […]

Covered Call Strangle Entry

Covered Call – The Strangle Entry When people learn option trading strategies they typically start with the old faithful of option trading strategies, the covered call. Trading a covered call option strategy is one of the foundation option trading strategies that everyone learns. But, what some people do not realize is that a covered call […]

IYR 9/24/18 Broken Wing Iron Condor

IYR – 09/24/18 – Broken Wing Condor I decided to place a Broken Wing Condor in IYR after a move down with no risk to the upside. I felt it had its run down and now was due for a rebound. Turns out I was wrong, that is the problem with trying to pick a […]

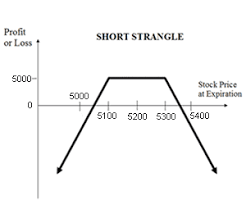

Strangles What Are they and How do We Trade Them.

Strangles – What are they and How do we Trade Them? Strangles are the only uncapped risk, limited reward strategy we trade. As a result we are highly selective about how we trade Strangles. We base our strangle trades like we place our probability based non-index and Broken Wing Iron Condors. We use probabilities and […]